Malaysia Kastam Duty

Every country is different and to ship to Malaysia you need. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division.

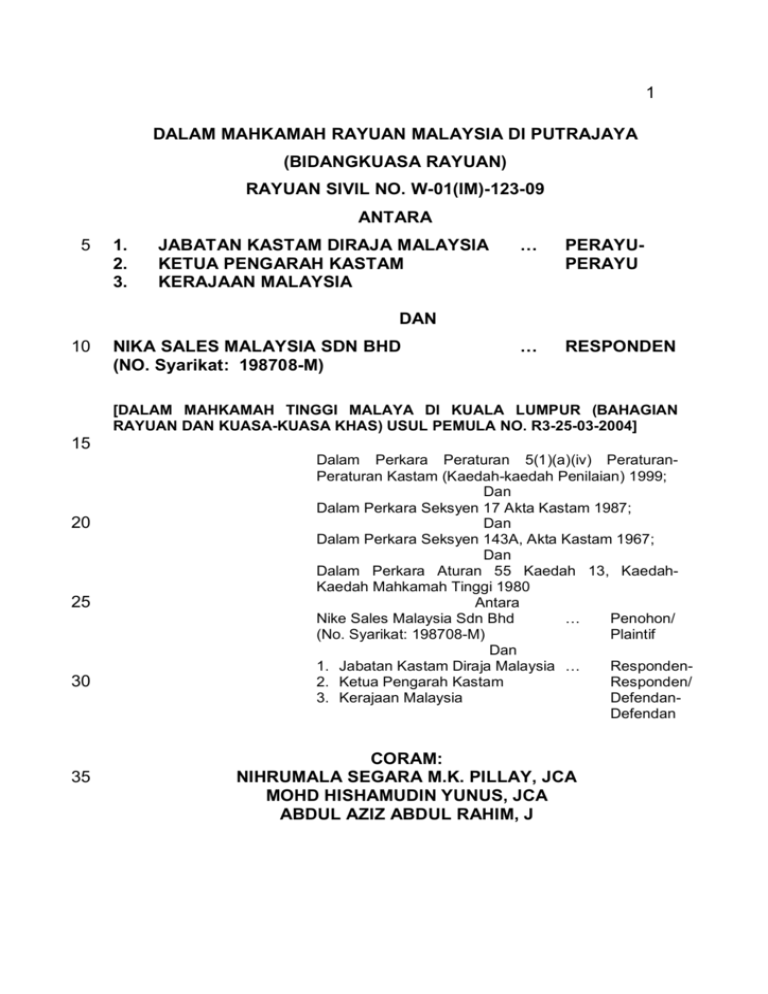

Rayuan Sivil No W 01 Im 123 09 Antara 1 Jabatan Kastam Dir

Sales tax is imposed on taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales.

Malaysia kastam duty. Apart from this KDRM implements 18 by-laws for other. Imported goods can only be released from customs control after the duty andor tax paid in full except as otherwise allowed by the Director General. HS Code Item Description.

-- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. New Malaysia excise duty regulations introduced for 2020 could see CKD car prices rise by up to 15 In Cars Local News By Hafriz Shah 17 January 2020 857 pm 244 comments. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers.

There are two types of Stamp Duty namely ad valorem duty and fixed duty. If you choose Delivery Duty Unpaid DDU there may be duty and tax above RM 500 see. Ikrar dalam Borang Kastam No.

Ikrar dan bayar duticukai untuk produk yang melebihi nilai ambang kandungan total sugar. Malaysias export value hit above one trillion mark in the first 10 months this. 1 Borang Kastam No.

Akademi Kastam Diraja Malaysia AKMAL Information Technology Division. Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. For the ad valorem duty the amount payable will vary depending on type and value of the.

Some goods are not subject to duty eg. Duti Kastam 2007 yang diimport pada atau dengan mana-mana orang yang memasuki Malaysia atau dalam bagasi orang itu dan yang dimaksudkan untuk kegunaan bukan. Garis Panduan Pemberian Penerimaan Hadiah JKDM.

In general term stamp duty will be imposed to legal commercial and financial instruments. When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. Permit for certain specific cases for example imports hand-phones and etc Alternatives Solution To Avoid from Custom Duties-1 Request your vendorshipper to.

Pastikan produk dilabelkan mengikut Peraturan-Peraturan Makanan 1985 yang menunjukkan dengan jelas kandungan total sugar dalam minuman tersebut. No NO 9 DIGIT FULL HS 9D. A 51 3 komersial kecuali kenderaan bermotor minuman beralkohol spirit tembakau dan rokok hanya duti kastam pada kadar sama rata 30 ad valorem hendaklah dilevi ke atas dan dibayar oleh pengimport atas barang itu.

When youre shopping online overseas one of the top concerns is getting taxed by Jabatan Kastam Diraja Malaysia. Malaysia by sea air or land. Garis Panduan Pemberian Penerimaan Hadiah JKDM.

The Royal Malaysian Customs Department Malay. Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. 1Where any imported goods are re-exported by the manufacturer as part or ingredient of any goods manufactured in Malaysia or as the packing or part or ingredient of the packing of such manufactured goods.

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. IMPORT DUTY STAGING CATEGORY. What is Excise Duty.

1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03 8882 21002300 Ibu Pejabat cccatcustomsdotgovdotmy. Things To Know When Shipping To Malaysia. Want to save time.

Garis Panduan Pemberian Penerimaan Hadiah JKDM. In the case of. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division.

RMCDs Strategic Plan. RMCDs Strategic Plan. In other words KDRM administers seven 7 main and thirty-nine 39 subsidiary laws.

Customs K1 form required supportive documents eg. Borang Ikrar Kastam K1 tersebut turut memerlukan dokumen sokongan seperti kebenaran atau Permit dalam kes-kes tertentu seperti import handphone dan lain-lain berkaitan. Malaysian exports in January-October exceed RM1 trillion The Sun Daily.

Trying to get tariff data. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. RMCDs Strategic Plan.

Ship it with us today. DUTY DRAWBACK LEGAL PROVISION. Malaysia Vietnam to achieve US18b bilateral trade by 2025 - Malay Mail.

Section 99 Customs Act 1967 Drawback on imported goods used in manufacture or in packing. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Live horses asses mules and hinnies.

Jabatan Kastam Diraja Malaysia abbreviated RMC or JKDM is the Malaysian Government agency responsible for administrating the nations indirect tax policy border enforcement and narcotic offences. What is Excise Duty. Pelan Antirasuah Organisasi JKDM.

Malaysia Vietnam to achieve US18b bilateral trade by 2025 Malay Mail. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Payment via chequebank draft must be made payable to Ketua Pengarah Kastam Malaysia and mail to. Upon arrival in Malaysia all goods need to be declared within one month from the date of import by the owner or his agent in the prescribed form.

Some goods may be zero-rated or exempt from GST. Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. What is Excise Duty.

Pelan Antirasuah Organisasi JKDM. Laptops electric guitars and other electronic products. Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and goods imported into Malaysia.

Pelan Antirasuah Organisasi JKDM. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Minimum thresholds Imports with.

Please make your selection. Whether or not your shipment will be taxed is somewhat of a gray area in Malaysia Buyandship suggests our members to be aware of the general rule of thumb for import tax and duty. View Full coverage on Google News.

Customs Recommended To Demand For Import Duty Shortfall Immediately

Komentar

Posting Komentar