Gst Payable Kastam

Item A selling RM29 price exclude GST RM2736 In our POS Systemif i am selling 10 pieces Item Atotal payable amount will be RM290 Right now my question is If someonenot company from Labuanpostage address to Labuan buying from us 10 pieces Item Atotal payable amount will be RM290 or RM27360. 2015 01 Apr 2015 to 30 Jun 2015 2015 DR 217104 CR 120004 97100 Lou Tax 000 000 000 No.

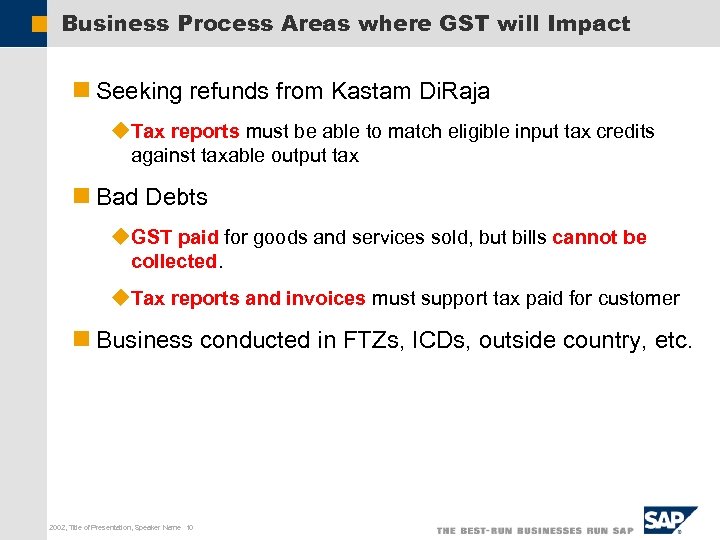

Goods And Services Tax Seamless Integration With Existing

The total amount payable excluding tax the rate of tax and the total tax chargeable shown as a separate amount The total amount payable including the total tax chargeable The Director General of Customs may upon request allow the tax invoice to be varied from the above whether in term of particulars in the tax invoice or issuance of other type of tax invoice eg.

Gst payable kastam. Any person who is aggrieved by the decision of the officer of. For example RM2203 will be rounded down to RM220. If Input is more than Output difference is GST Credit.

PAYMENT ON RETURN 21 Make A Payment Login into TAP The taxpayer has the ability to make a payment through the Taxpayer Access Point TAP either by login or without login. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft. GST Payable Form 3 Bonded Warehouse LMW K1 K9 With ATS GST is suspended No ATS subject to GST payable in K1 K9 However if the goods in the bonded warehouse are not imported goods but belongs to LMW or FIZ companies the supply of such goods when they are removed from the warehousing scheme the GST treatment is as shown in Table 3 below.

33 Person includes a company a body of persons a limited liability partnership and a corporation sole. METHOD OF PAYMENT OF SALES TAX AND SERVICE TAX. Payment via chequebank draftmoney order must be made payable to Ketua Pengarah Kastam and mail to.

B Permit to transship or remove goods K8 eg. Cheque payable to KETUA PENGARAH KASTAM MALAYSIA GST Import should be paid according to normal importation payment procedure. For example RM2206 will be rounded up to RM 221.

No GST return is made. How to handle if you have processed GST-03 and later received a supplier invoice. For payment of taxes online the maximum payment allowable is as follows.

Any refund paid to which there is no proper entitlement. Goods and Services Tax. What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST.

Any deficiency on the net tax payable. If Output is more than Input difference is GST Payable. GUIDE ON IMPORT As at 12.

Approved Toll Manufacturer Scheme ATMS. COMPLAINT. For corporate account payments B2B the amount is RM100 million.

For GST Import cheque made will be payable to PENGARAH KASTAM NEGERI. Goods removed for outright export from Free Industrial Zone Pulau Pinang to LTA Bayan Lepas Pulau Pinang or goods removed from Public Bonded Warehouse to LTA. Any taxable person registered under the ATS will be allowed to suspend GST payable on imported goods at the point of importation.

A Export declaration form K2 K8 with endorsement on Remarks column in Sistem Maklumat Kastam SMK A claim for input tax under the GST Act 2014 will be made. Set Tax Date in Purchase Invoice. This guide shows how you can process GST with Net Realised Exchange.

The total GST payable on all goods and services shown on a tax invoice may be rounded off to the nearest whole cent ie. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. PAYMENT ON RETURN 21 Make A Payment Login into TAP The taxpayer has the ability to make a payment through the Taxpayer Access Point TAP either by login or without login.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. GST Amount Payable 6220704 NOTE. GST Calculator GST shall be levied and charged on.

With one-click GST reports our small business customers save hours freeing up time to grow their business. We do not have to pay challan. CLIENTS CHARTER PRIVACY POLICY SECURITY POLICY DISCLAIMER RSS.

These are the entries that a person is required to update under the new regime of GST. A Purchase of passenger motor car b Hire of. The GST suspended need to be declared and accounted for in the following taxable period.

Importation of goods is also subject to GST at standard-rated 0. Terms input tax refers to GST payable on business purchases and importation. Example- Interbank GIRO IBG transaction.

EVENT CALENDAR Check out whats happening. Output SGST Ac. Payment via chequebank draftmoney order must be made payable to Ketua Pengarah Kastam Malaysia and mail to.

If the GST payable amounts to a fraction of a sen the following treatment will apply. In simple terms output tax is the GST charged on sales inventory capital assets etc deemed supplies and imported services. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. AGENCY Browse other government agencies and NGOs websites from the list. A GST return is submitted without payment or a lesser payment.

Description Rounding Mechanism For fraction of a sen that is 0005 sen and above Rounded up. 32 Output tax has the same meaning assigned to it in the GSTA. Any deficiency on the net tax payable No GST return is made A GST return is submitted without payment or a lesser payment Any refund paid to which there is no proper entitlement Failure to register Ketua Pengarah Kastam Jabatan Kastam Diraja Malaysia Pusat Pemprosesan GST Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor Assessment Disputes Review and.

We have to pay this amount to governemnt by depositing challan. Small businesses in countries like Australia Canada Singapore and UK already rely on us to help them track and report GST. Realised Gain Loss Foreign Exchange.

GST Payable 97100 GST-03 GST 2015 Eile Edit Liew Customer Supplier Sales eurchase Stock Prgduction SST GST Return Process process Date 30062015 To 301062015 C CF Refund for L onw Period Description Ref Ref 2 GST Return - 2015 to 30 2015 process. Total Output Tax Total Input Tax and GST Amount Payable will AUTO POST a journal entry as double entry in below- GL Acc GL Description DR CR GST-201 GST-Payable 6229500 GST-101 GST-Claimable 8796 GST-KASTAM GST-Payable Kastam 6220704. For fraction of a sen below 0005 sen Rounded down.

Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan GST Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. All supplies of goods and services which are now subject to GST at standard-rated 6 becomes standard-rated 0 effective on 01 June 2018. For GST Import cheque made will be payable to PENGARAH KASTAM NEGERI.

It gets added in input of next month. To Input SGST Ac. Review and Appeals.

Payable or claimable 4 4810000 GST Liability AR Balance Sheet None For GST Bad Debt handling on customer 5 4820000 GST Claimable AP Balance Sheet None For GST Bad Debt handling on supplier 6 4830000 GST Suspense Balance Sheet None GST on importation of Goods 7 9801000 GST Expense Profit Loss None For no claimable input tax. Besides these if there is a tax liability than the entry for payment of such tax liability is required to be a pass. Segala maklumat sedia ada adalah untuk rujukan sahaja.

Cheque payable to KETUA PENGARAH KASTAM MALAYSIA GST Import should be paid according to normal importation payment procedure. We have already added in Malaysia GST tax codes Form 3 and General Audit File GAF to QuickBooks Online.

Komentar

Posting Komentar